50 Technologien für den M&A-Prozess

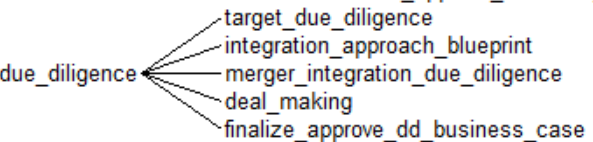

Es gibt eine Herausforderung für M&A-Fachleute: Sie kennen oft nicht alle Technologien, die verfügbar sind und ihnen das Leben erleichtern könnten. Aus diesem Grund habe ich eine große Anzahl von Technologien definiert, die für verschiedene Aufgaben im M&A-Prozess anwendbar sind. Auf diese Weise können wir zeigen, welche Werkzeuge welche Technologien verwenden und wie die Technologien entlang der Aufgaben des M&A-Prozesses verteilt sind.

Die Attribute sind wie folgt definiert:

Fortgeschrittene Analytik

Fortgeschrittene Analysen verwenden nicht-deskriptive statistische Methoden wie Schätzungen oder Interpolationen oder Entscheidungsunterstützung.

Erkennung von Mustern

Mustererkennung ist die Fähigkeit, Muster in Daten zu erkennen.

Erkennung von Anomalien

Die Erkennung von Anomalien ist die Fähigkeit, automatisch Anomalien in Daten zu erkennen, wie z. B. Ausreißer innerhalb einer Verteilung.

Artikel

Artikel sind Auszüge aus Büchern, Blogs oder anderen Veröffentlichungen zu einem bestimmten Thema.

Erweiterte Analytik

Augmented Analytics sind Analysefunktionen, die automatisch Hintergrundinformationen aus internen oder externen Quellen zur Verfügung stellen, die sich auf die jeweilige Aufgabe beziehen.

Automatische Schwärzung von Dokumenten

Wenn kritische Teile von Dokumenten ohne menschliches Zutun geschwärzt werden können, spricht man von automatischer Schwärzung.

Automatische Identifizierung fehlender Daten

Ein wichtiges Thema bei M&A sind fehlende Daten. Wenn ein Werkzeug das Auffinden fehlender Daten ohne menschliches Eingreifen ermöglicht, nennen wir dies automatisches Auffinden fehlender Daten.

Automatische Verdichtung

Wenn mehrere Originaldokumente zu einem Dokument zusammengefasst werden können und das resultierende Dokument kürzer ist als die Summe der Originaldokumente, nennen wir dies automatische Zusammenfassung, wenn diese Zusammenfassung in einem vollautomatischen Prozess erfolgt.

Automatische Übersetzung

Das maschinelle Übersetzen eines Textes oder eines Dokuments in eine andere Sprache wird als automatische Übersetzung bezeichnet.

Hintergrundinformationen

Hintergrundinformationen sind reale Daten aus Quellen innerhalb oder außerhalb eines Unternehmens, die helfen, den Sachverhalt zu verstehen und zu analysieren.

Chat

Chat ist eine Werkzeugfunktion, die eine schriftliche Ad-hoc-Interaktion zwischen zwei Benutzern eines Werkzeugs ermöglicht.

Kollaborationsräume

Kollaborationsräume sind elektronische Räume, in denen Menschen elektronisch miteinander interagieren können, z. B. Dokumente austauschen, Inhalte gemeinsam erstellen und miteinander kommunizieren.

Privatsphäre und Datenschutz

Die Gesetze in den verschiedenen Ländern schreiben bestimmte Regeln für den Zugang zu und den Schutz von personenbezogenen Daten vor. Die Auswirkungen dieser Gesetze werden unter den Begriffen Datenschutz und Datensicherheit zusammengefasst.

Datensicherheit

Die Datensicherheit gewährleistet, dass nur befugte Personen auf die Daten zugreifen können.

Prüfpfad

Ein Datenspeicher mit Audit-Trail schreibt und speichert Protokolle über alle Aktivitäten von Benutzern mit den im Datenspeicher befindlichen Daten.

Mehrdeutigkeit

Bei der Disambiguierung wird eine der vielen möglichen Bedeutungen eines Begriffs ausgewählt.

Klassifizierung von Dokumenten

Automatische Klassifizierung bedeutet, dass Dokumente anhand von Metadaten oder dem Inhalt solcher Dokumente kategorisiert werden.

Dokument-Redlining

Das Redlining von Dokumenten bedeutet, dass ein Werkzeug eine Markierung der in einem Dokument vorgenommenen Änderungen anbietet.

Versionierung von Dokumenten

Die Dokumentversionierung bietet eine Historie der Dokumente und ermöglicht es, jede der vergangenen Versionen zu sehen.

Alleiniger Zugang in EU-Ländern

EU-Zugriff bedeutet, dass die Daten innerhalb der Europäischen Union gespeichert werden und nur die in der EU ansässigen Mitarbeiter des Werkzeugherstellers Zugriff auf die Daten haben.

Forensische Suche

Die forensische Suche ermöglicht das Durchsuchen vorhandener Daten auf der Grundlage semantischer Beziehungen zwischen in Dokumenten oder Daten enthaltenen Entitäten.

Hilfe-Technologie

Die Hilfe ist ein Inhalt, der den Benutzer bei der Ausführung einer Aufgabe mit dem jeweiligen Tool unterstützt.

Unterstützte Hyperscaler

Dieses Attribut gibt an, welche Hyperscaler verwendet werden können.

Funktionen zur Datenintegration

Datenintegration ist die Fähigkeit eines Werkzeugs, Daten aus verschiedenen Datenquellen zu integrieren.

Intelligente Assistenten

Intelligente Assistenten, die auf einen Benutzer achten, den Kontext und die Absicht des Benutzers verstehen und dem Benutzer bei der Ausführung der Aufgabe helfen.

Wissensgraphen

Wissensgraphen sind semantische Darstellungen eines Bereichs in Form eines Graphen. Die Knoten und Kanten des Graphen stellen semantische Konzepte der Domäne dar.

Mehrsprachigkeit

Mehrsprachigkeit ist die Eigenschaft eines Tools, eine Benutzeroberfläche und Funktionen in verschiedenen Sprachen bereitzustellen.

Andere Anwendungen des maschinellen Lernens

Dieses Attribut fasst alle anderen Möglichkeiten der Nutzung des maschinellen Lernens in Werkzeugen zusammen, die nicht durch die anderen Attribute zum maschinellen Lernen abgedeckt sind.

Abspielbücher

Playbooks sind vordefinierte Dokumente, die beschreiben, wie Aufgaben ausgeführt werden.

Aufgabenspezifische Fragen oder Fragebögen

Fragen sind Anfragen nach Informationen, die zur Erfüllung der jeweiligen Aufgabe benötigt werden. Die Fragen werden oft in Form von Fragebögen nacheinander aufgelistet.

Beispiele aus der Praxis

Real-Life-Beispiele sind Inhalte zu einer Aufgabe, die von Praktikern stammen und über Erfahrungen bei der Ausführung der Aufgabe in realen M&A-Projekten berichten.

Robotergestützte Prozessautomatisierung

Die robotergestützte Prozessautomatisierung ermöglicht es Benutzern, Arbeitsabläufe zu beschreiben und auszuführen.

Beispielhafte Inhalte

Beispielinhalte sind Dokumente, die sich auf die jeweilige Aufgabe beziehen.

Ein nahtloser Übergang zwischen Aufgaben

Nahtlose Erfahrung ist die Anforderung, eine oder mehrere Aufgaben auszuführen, ohne zwischen verschiedenen Tools wechseln zu müssen.

Nahtlose Integration mit anderen Werkzeugen

Nahtlose Integration bedeutet, dass keine manuellen Eingriffe erforderlich sind, wenn ein Wechsel zwischen verschiedenen Werkzeugen erforderlich ist.

Sicherer Dateibetrachter

Zur Vermeidung von Datenverlusten oder -lecks

Sicherheitsprüfpfad

Ein Sicherheits-Audit-Trail liegt vor, wenn ein Tool alle sicherheitsrelevanten Aktivitäten aufzeichnet und die Abfolge dieser Aktivitäten zusammen mit den Informationen darüber, wer was getan hat, bereitstellt.

Semantische Interpretation von Daten

Semantische Interpretation bedeutet, dass Daten, z.B. Bilder oder Zeichenketten oder Zahlen, automatisch eine semantische Bedeutung zugewiesen bekommen.

Semantische Suche

Die semantische Suche ermöglicht es, Daten anhand ihrer semantischen Interpretation zu suchen.

Analytik

Einfache Analysen sind deskriptive Statistiken und deren Visualisierungen.

Suchfunktion

Wenn Sie nach einer Folge von Wörtern suchen und diese in verschiedenen Dokumenten finden können, wird dies als einfache Phrasensuche bezeichnet.

Spracherzeugung

Spracherzeugung ist die Fähigkeit eines Tools, Text in gesprochene Sprache umzuwandeln.

Spracherkennung

Spracherkennung ist die Fähigkeit eines Werkzeugs, gesprochene Sprache in Text umzuwandeln.

Aufgabenspezifisches Training

Aufgabenspezifisches Training ist ein Inhalt, der den Benutzer in die Lage versetzt, die anstehende Aufgabe unabhängig von den Werkzeugen auszuführen.

Telefonie

Telefonie ist das Führen von Audioanrufen über ein Werkzeug.

Werkzeugspezifische Schulung

Tool-Schulungen sind Inhalte, die den Benutzer in die Lage versetzen, die Aufgabe mit einem bestimmten Tool auszuführen.

Benutzerunterstützung

Die Benutzerunterstützung ist die Summe aller Werkzeugfunktionen, die dem Benutzer bei der Ausführung seiner Aufgabe mit einem Werkzeug helfen.

Virtuelle Besprechungen

Virtuelle Meetings sind Meetings, die mit Hilfe eines Tools durchgeführt werden. Das Tool verbindet und ermöglicht die Kommunikation zwischen Teammitgliedern an verschiedenen Standorten.

Watermarking

Ein Wasserzeichen ist eine Unterschrift auf einem Dokument, die oft auf jeder Seite angebracht wird. Wasserzeichen können zur Erstellung eines Prüfpfads verwendet werden.

Whiteboarding

Whiteboarding ist ein gemeinsam bearbeitetes Dokument, das von mehreren Benutzern parallel geändert werden kann.

Dies bezieht sich auf mein neues Buch “Automation of Mergers and Acquisitions“.

CLICK OR SCAN THE QR CODE TO ORDER THE BOOK