The struggle

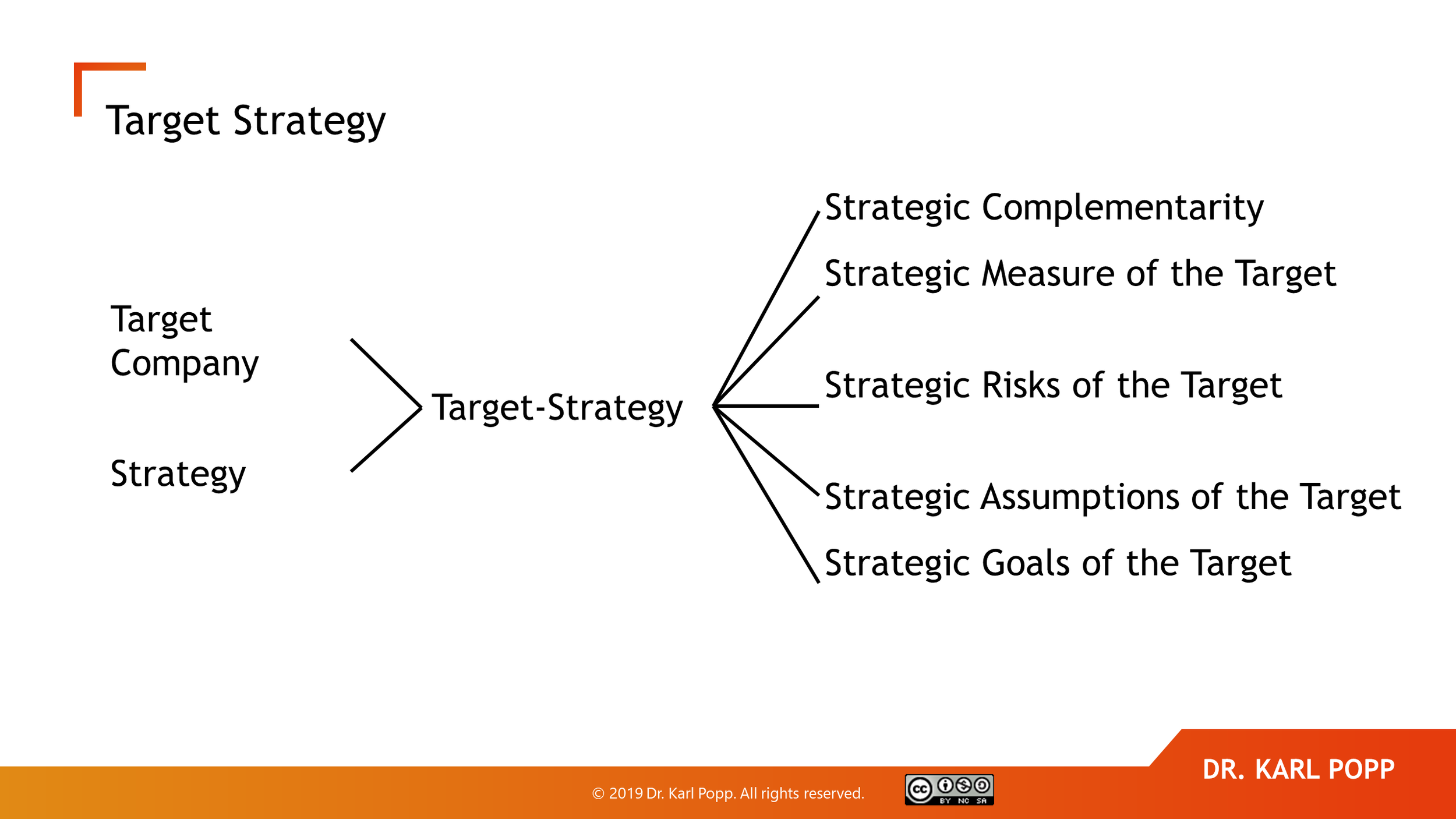

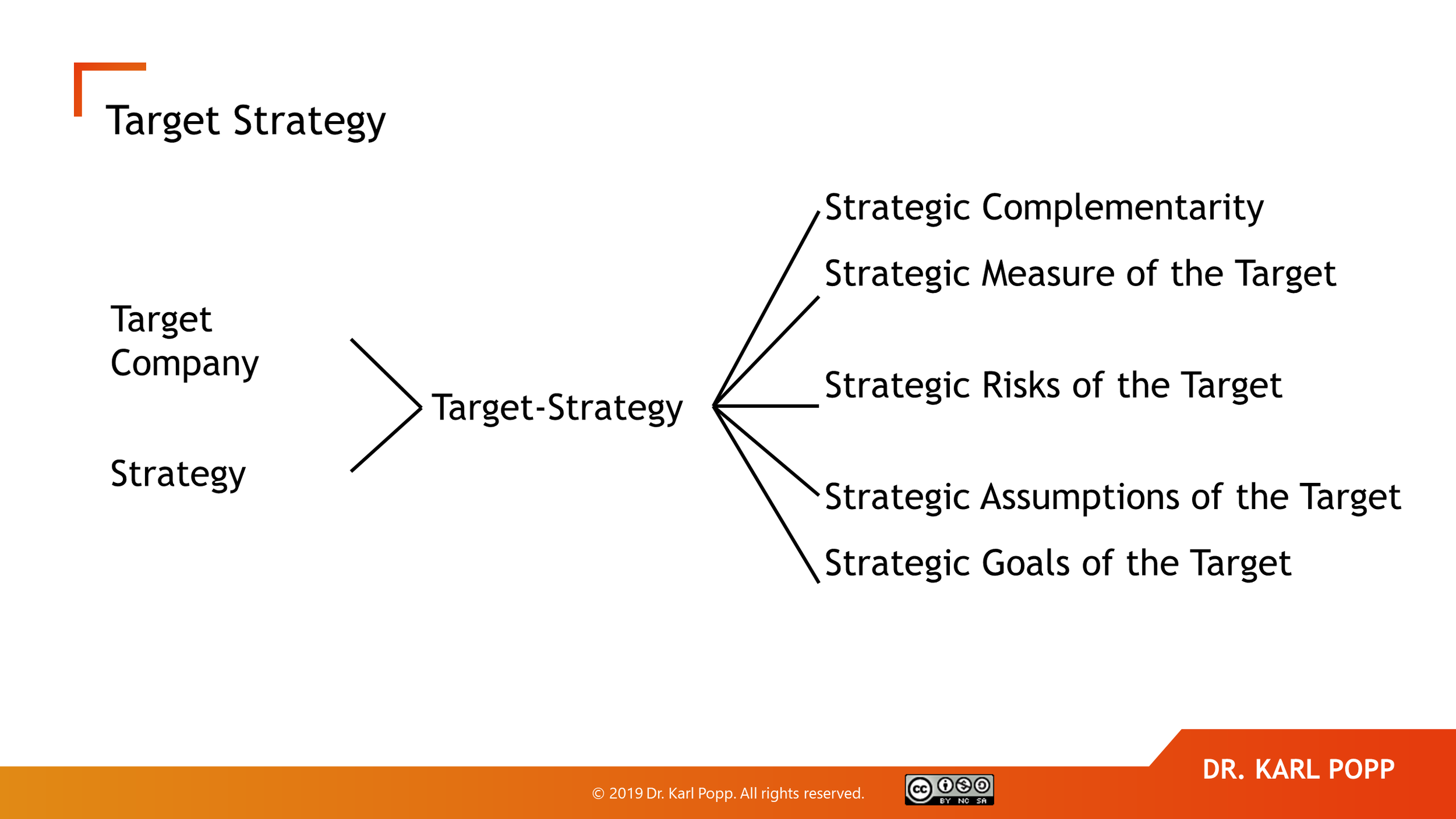

Many companies struggle with defining their strategy.

OK, they finally make it.Then they struggle finding the right target.

They finally find one. Again, they struggle to determine the target fit.

Considering that errors made in early in the process are the most expensive ones, we have to change the situation urgently.

Histogram of tools in M&A strategy

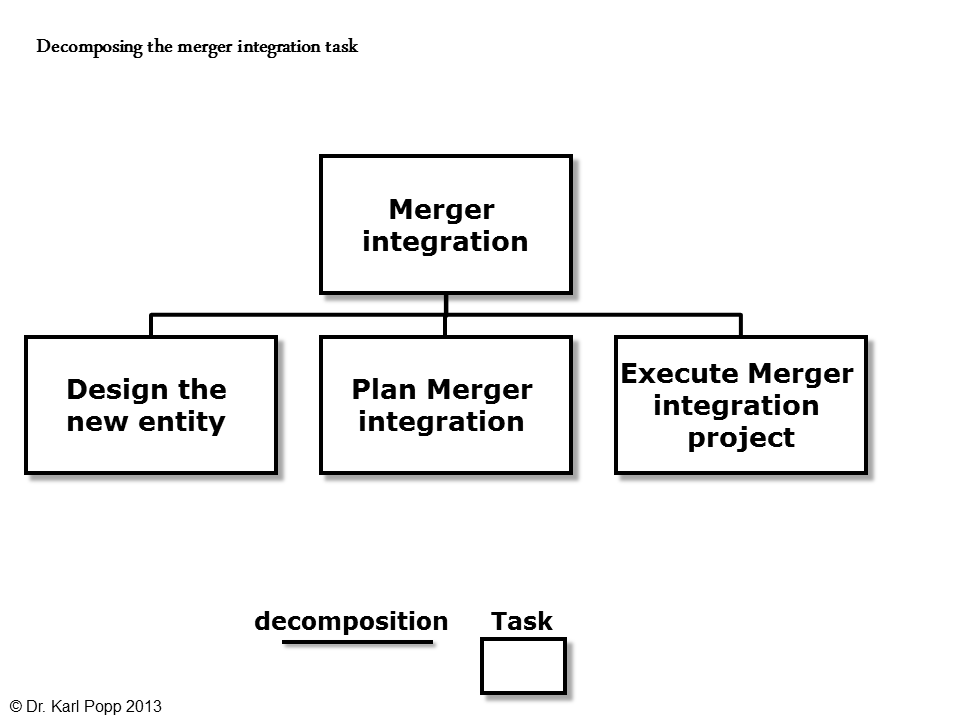

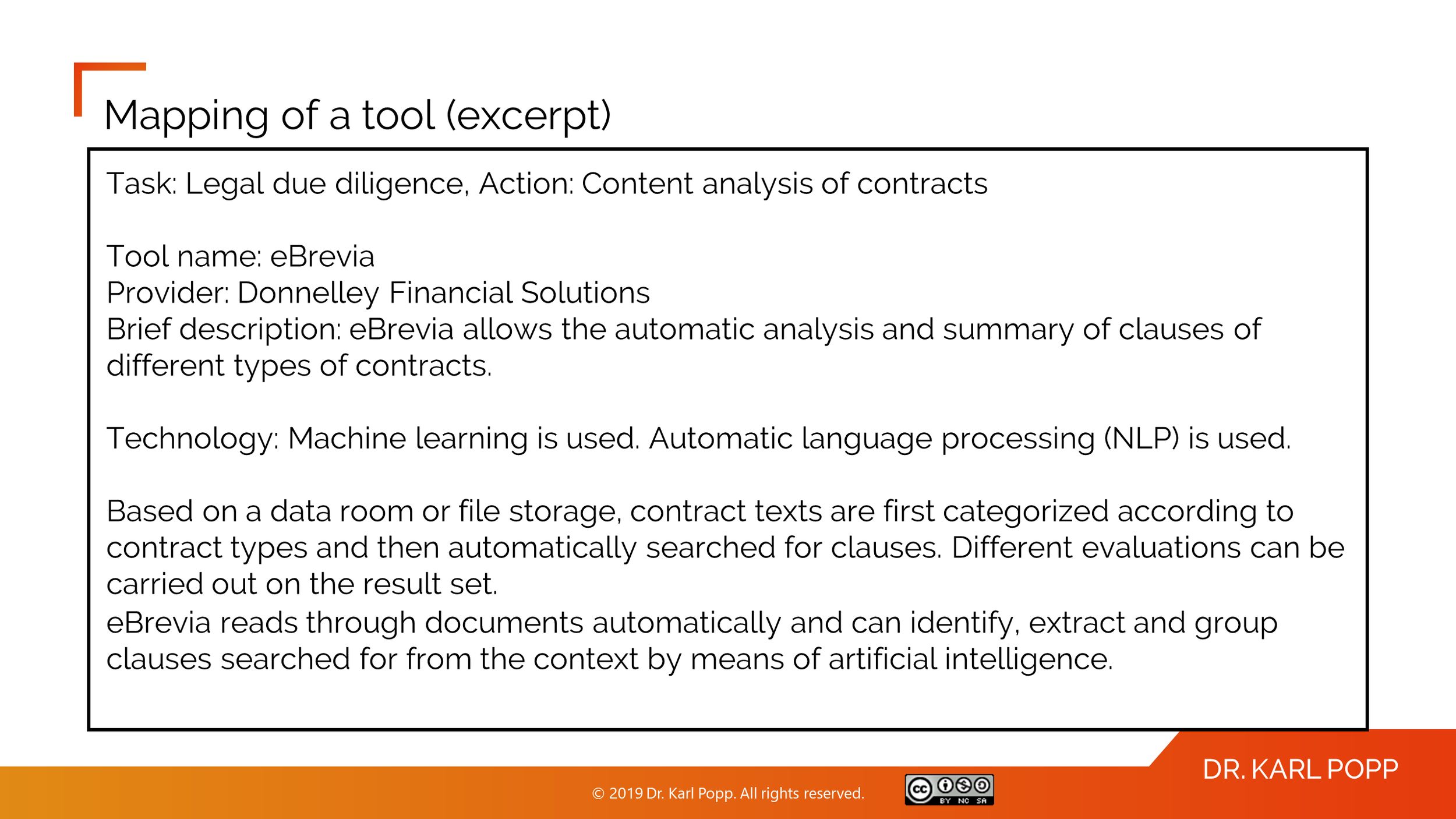

I have created a list of tools per task in the M&A strategy phase. Let us have a look at the task Finding Potential Targets . The goal of the task is to create a longlist of target companies. First, you define the selection criteria and the market, then you scan certain sources for potential targets. After that, you review companies to join the longlist. Maybe you have a management level meeting with the target to learn more. Summarizing the results you wil have a longlist of suitable companies to further reduce in the next step.

So, how many tools are there to support me in this task?

In this example, which is not exhaustive, there are 15 tools or services that can be used. So why do we find many tools for this task? For me, the main reason is that search and matching technology is in the market for a long time and is available to many companies.

But to what degree is the task automated by each tool?

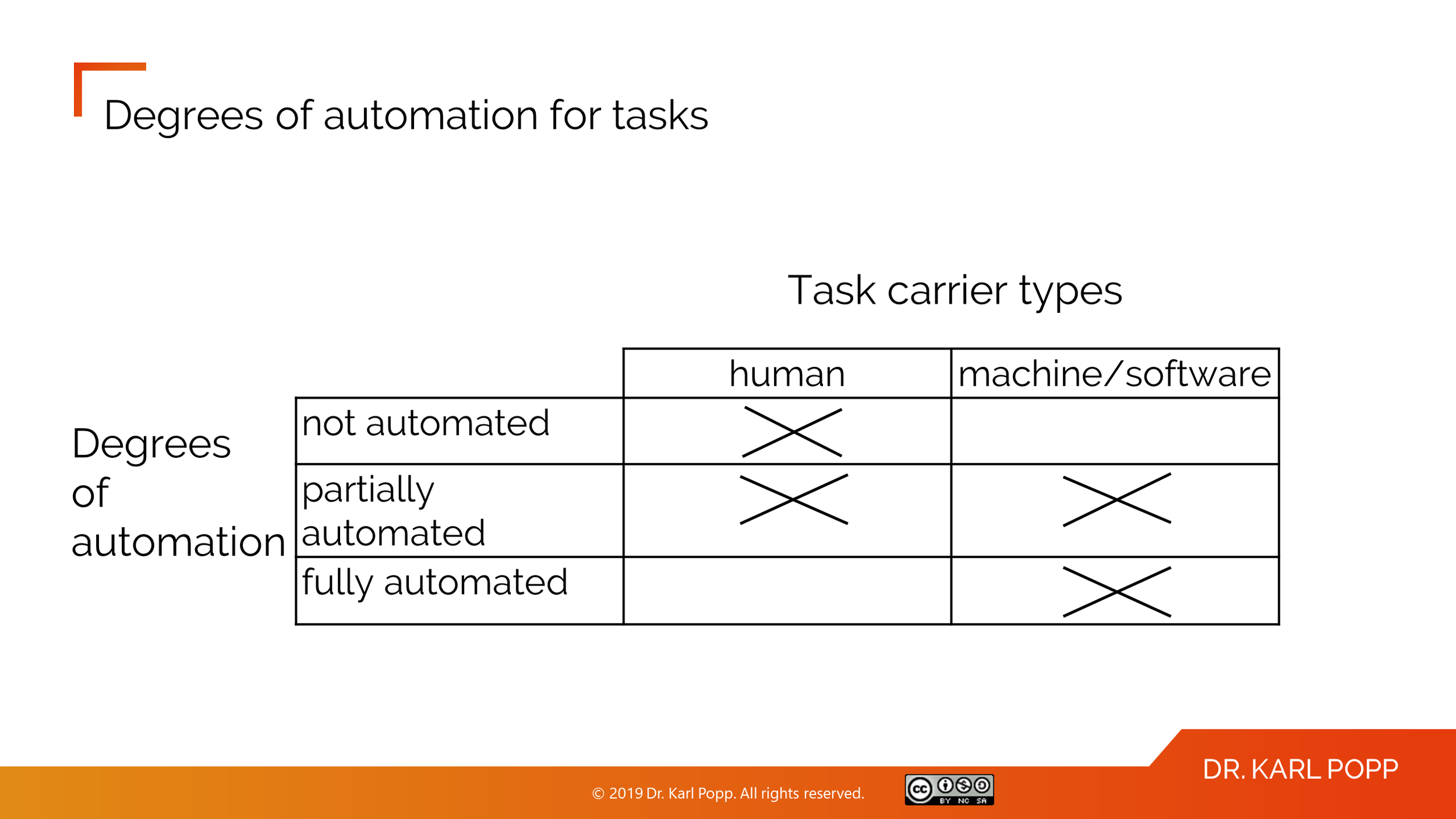

We look at it the following way: Each task has a number of activities that are carried out during the execution of the task. We could assign a degree of automation to each of the actions to see how much automation is provided.

Here, The task consists of the following actions

Define selection criteria and market

Scan sources for potential targets

Review companies to join the longlist

Define the longlist of targets

By assigning each action a degree of automation provided by each tool, we can see what opportunities for automation. I will present the results in one of the following posts.

Please have a look at my current book “Automation of mergers and acquisitions“ by scanning one of the QR codes below. I have also provided an overview of interesting books below.